We have been actively pursuing opportunities available in select commodity markets, resulting from significant and structural supply and demand imbalances. We believe this will result in higher prices for some commodities for an extended period of time.

Oil prices have strengthened considerably lately. We’ve been calling for this for a while now, with a few reasons as follows:

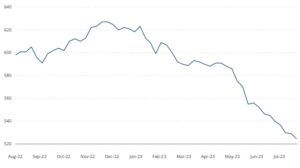

- Supply is tightening as oil companies adjust to weaker prices, higher costs, and returning cash to shareholders. The chart below illustrates rig counts in the U.S. As you can see, energy firms have consistently cut the number of oil rigs in operation. This is a forward gauge of future output, and it tells us that supply will fall.

US Crude Oil Rig Count

Source: Bloomberg. As of 8/1/2023.

- OPEC+ has agreed to cut oil production in an effort to support oil prices. In July, Saudi Arabia and Russia, the world’s largest oil exporters, announced further cuts to support prices.

- Oil prices have been under pressure from the draining of the strategic petroleum reserve to 40-year lows. While we do not know how the near term will unfold, it is more than evident that, at best, this is not a long-term solution to higher energy prices, and we should not rely on the government to tame energy prices in perpetuity.

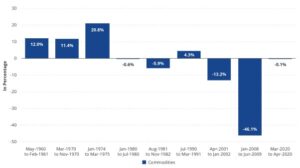

The risk to oil and other commodities, in the short term, is the economy. But, given the broad expectations of a shallow recession, we think that risk is severely overstated. The chart below demonstrates that commodities have historically fared well during recessions, apart from the unusually deep recession caused by the 2008 Global Financial Crisis (“GFC”). And, when high inflation is present during a recession, as we experienced in the 1970s, commodities performed very well. The COVID-19 commodity correction does not show in the chart because it was a short-term price shock that quickly recovered.

Annualized Returns During Recession

Source: Bloomberg & NBER. As of 6/2023.

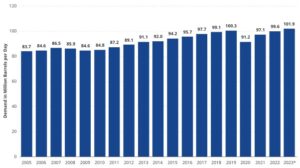

To understand why commodity prices have generally performed well during the “typical” recession, let’s look at the historical demand for oil. The chart below demonstrates that the oil demand is relatively inelastic. Meaning that, with the exception of truly extreme events, such as 2008 and COVID-19, oil demand is relatively unchanged.

World Oil Demand

Source: OPEC. As of 4/2023.

We love to complain about high petrol prices, but that doesn’t stop us from driving. I complained about paying $2 per litre. But what really matters is not that I complained but that I still drive and fill up at the petrol station.

Unless you are calling for a super draconian recession, and very few that we meet are, then, in our view, commodities offer the potential for significant diversification and performance benefits.