Introduction

As we move through the new financial year, it is the opportune time to pause and reflect upon the key economic developments that have shaped our investment landscape, and anticipate the trends that will guide us throughout the new financial year.

Our report will address the following key themes:

- US Debt Ceiling and Banking Crisis: An in-depth review of the implications of the US’s fiscal challenges, and how they have reverberated throughout the banking sector.

- Ukraine War: An exploration of the economic reverberations of the conflict in Ukraine, both globally and locally.

- Inflation: A detailed analysis of the persistence of inflationary pressures, their causes, and their impact on our investment strategies.

- US Tech and Equity Position: A celebration of the resilience of the US Tech and Equity market, and its influence on our investment decisions.

- Chinese Economic Rebound: A close look at China’s economic resurgence, and how it is altering the contours of the global economy.

- Interest Rates and Expectations: A thorough examination of current interest rate trends, and what they mean for our future investment outlook.

Our goal remains unchanged; to guide you through these challenging times while maintaining a steadfast commitment to your lasting financial well-being. We extend an invitation for you to accompany us as we explore essential subjects, aiming to provide you with a thorough grasp of both the present and future economic environment.

US Debt Ceiling and Banking Crisis

Given the limited impact on equity markets, it’s hard to reconcile that 2023 was a year of what was called a “Banking Crisis”. Over a short period of time, major regional and connected banks in the US collapsed, with Silicon Valley Bank, then Signature Bank and First Republic Bank going the way of the dodo.

Outside of their individual issues, the broader headwinds of rising interest rates, declining commercial property values, and looming recession concerns set the scene for the precarious banking situation.

While US government agencies addressed the situation quickly and effectively, there remain some core factors that increase risk, namely commercial real estate vacancy and falling commercial valuations. Banks that hold a large amount of debt backed by commercial real estate remain a higher-risk option as new supply comes online and vacancy rates remain elevated.

Ukraine War continues

The Ukraine war continues and shows little signs of stopping. There was brief hope of reprieve upon the “protest/coup” of the paramilitary organisation Wagner Group, however, this was quickly resolved and potentially a somewhat performative way to bolster troop numbers in Belarus and closer to the Polish border.

Our base case remains that there won’t be a resolution to the war, at least not in the short term. Regardless, the impact of a resolution is uncertain, given Europe and the globes success in adapting supply lines and energy access.

A cold European winter may test the progress they made last year due to increased pressure on the adjusted energy supply lines. Countries, such as Germany would be the most effected in this type of scenario.

Inflation

Stronger than expected demand, driven by full employment and latent household savings, maintained demand, while supply lines that continued to work through geopolitical and economic constraints led to stubborn inflation early in the year.

As household savings and confidence tapered and supply improved, we saw a slow but sure decline in the inflation data.

We see this as evidence that central banks have so far struck the right balance in bringing inflation back to target without causing undue volatility or stress in the economy. This is supportive of a “Soft landing” base case for the year ahead.

Nevertheless, the continuing rise in US debt raises apprehensions, and there is a probable necessity for another bout of QE (Quantitative Easing) to manage the swiftly increasing US interest obligations. Additional QE would lead to asset price inflation, coupled with more widespread inflationary pressures.

Interest Rates and expectations

Central banks broadly reached restrictive levels with their monetary policy, with real interest rates finally becoming positive. While there may be a few more rate increases to come, it is likely we will see the zenith of rates in the 2024.

However, the question of how long rates will be kept at these elevated levels remains. Given the latest commentary from the Fed and the slowly resolving inflation data we predict rates will be held around these levels in the short to medium term. There remains a long way to go before inflation nears target levels.

US Tech and equity positioning

The rising interest rates have key implications for equity market positioning. Companies that rely on cheap debt and have limited free cash flow will continue to struggle in this environment, whereas quality companies with good debt coverage are likely to perform better. Cash-rich companies, such as mega-cap tech may also be sheltered from sustained high-interest rates.

Caveat to this is the potential that policymakers have been making allowances for these mega-cap companies by slowing tech regulation, as their efficient and popular services offset voter dissatisfaction and diminishing confidence as the global economy slowed. This may be coming to an end.

With major elections looming, an element of scapegoating may lead to an increased focus on AI and tech regulation. This political scrutiny may come at a difficult time for tech companies as they race to integrate the efficiencies of AI into their business.

The outcome of major AI advances remains uncertain at this stage but is likely to be benign in the next 12 months, improving productivity but not yet disrupting employment in a material way.

Chinese economy rebounding

The Chinese economy suffered several false starts as shifts in rhetoric and implemented stimulus failed to offset falling activity and increasing perception of geopolitical risks.

With an absence of inflation, further stimulus planned, increased spending on building factories and industry, along with a potential return to the residential property paradigm, we are beginning to see some green shoots.

While China may be entering a recovery phase, a more prudent play on this theme may be buying Australian companies most likely to benefit from increased Chinese activity.

Outlook

Global markets

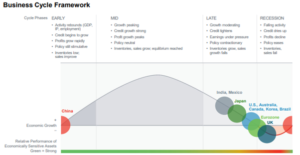

Many economies face headwinds related to persistent inflationary pressures and tightening monetary conditions. However, the global cycle is not overly synchronized. China’s economy continues to benefit from its post-COVID reopening, while Europe has stabilized amid falling energy prices. We believe the U.S. is in the late-cycle expansion phase, with solid near-term momentum but a high probability of greater slowing ahead.

America

The US is facing a gradual slowdown with mixed effects on financial markets. The slowdown looks ongoing due to excess pandemic savings, stable corporate profits, and improved housing indicators. Manufacturing could get a temporary boost from inventory rebuilding. Though a recession might be avoided, recent US interest rate hikes are increasing Treasury spending while lower asset prices reduce income. The Fed’s actions inject money but hamper business output.

A red arrow in the chart shows what might occur if rising rates trigger a recession, leading to a significant increase in the US deficit. This suggests poor prospects for long-term US Treasuries, which may not perform well during a recession.

With significant Treasury borrowing ahead, the Fed might need to implement QE and YCC sooner to manage deficits at viable rates. This implies a need for careful investment choices:

- Overweight gold, gold miners, and electrical infrastructure stocks.

- Hold oil, EV-related commodities, short-term or variable rate debt, and cash.

- Underweight long-term debt.

Europe

Economic growth in the eurozone is faltering due to a sharp drop in bank lending, and ongoing inflation pressures are pushing the EU to tighten policies, even in the absence of significant growth. European investors in equities should exercise caution in the upcoming months as the impact of higher interest rates becomes more pronounced. While the European economy has shown resilience so far, it’s unlikely that the current rapid series of rate hikes will result in anything other than a notable slowdown. The recent slowdown in the once-vibrant services sector suggests that the ECB’s efforts to control the economy might be working.

Despite this, European earnings are outpacing those in other developed markets, the US stock market is reliant on a small group of companies for leadership, and European equities remain attractively priced historically and in comparison to US equities. This suggests that Europe might be better positioned to weather the next few quarters as the economic cycle potentially worsens. However, it’s still wise to exercise caution given the circumstances.

China

China’s post-COVID reopening growth has not been as strong as anticipated, as indicated by recent economic data releases. On a positive note, China has experienced relatively low inflation, allowing the People’s Bank of China (PBoC) to reduce rates and implement fiscal and regulatory support to stimulate the sluggish economy. These measures have already begun and are likely to continue throughout the year.

Official data continues to reveal an unchanged Year on Year (YOY) consumer price index in China, falling short of the expected annual inflation rate. This data contributes to the growing evidence that China’s recovery after COVID-19 has significantly slowed down. Consumers are holding back spending due to concerns about economic growth and asset prices, particularly in the struggling property sector. Preliminary data shows that the value of new home sales by China’s top 100 real estate developers plummeted by 28.1% in June compared to the previous year.

Anticipated for the second half of the year, Chinese stocks are expected to be volatile as investors grapple with the extent of policy stimulus needed to revive the weakening economy. It’s crucial to be selective in investment choices since some areas have exceeded their fundamentals, while others are lagging despite a positive outlook.

Although the recovery in consumption is still unfolding, it’s progressing more slowly than the initial optimistic expectation of a rapid rebound (V-shaped recovery). Despite this, we view the recent weakness as an opportunity and maintain a ‘hold rating’, with a preference to obtain exposure via Australian based companies that would benefit from Chinese economic expansion.

Australia

Australia’s economic outlook now aligns with other major developed economies due to persistent core inflation, leading to a higher-than-expected peak in the cash rate. As a result, there’s a slightly deeper economic downturn than previously anticipated for 2023.

We believe Australia is likely to avoid a recession, unlike several other developed economies. Positive factors include a population growth rebound and moderate fiscal support driven by unexpectedly large commodity price gains. However, this outlook is on the verge of uncertainty due to the RBA’s determined stance against inflation.

Unfortunately, Australia is heading towards its weakest economic growth period since the Global Financial Crisis. Annual growth is projected to drop from 3.7% in 2022 to 1.3% in 2023 and further down to 0.8% in 2024. Despite a robust job market and pandemic-related savings, rising interest rates are impacting household incomes and causing consumer spending to slow, making conditions feel recessionary for many.

Looking ahead, the Reserve Bank of Australia (RBA) must prioritize price stability and policy credibility, even at the expense of short-term economic growth. The choice is between enduring temporary tight policy conditions or navigating through a period of heightened inflation and growth uncertainty. While Australia’s rising policy rates may be managed better than other developed markets, thanks to strong population growth, housing prices, and government spending, some near-term pain is deemed necessary for long-term gains.

Investment Portfolios

Our preference lies with the “quality factor,” which encompasses stocks characterized by low debt and stable earnings growth. These stocks typically exhibit robust performance relative to others during periods of economic deceleration.

Our recommended portfolio strategies advocate a defensive stance in both stocks and bonds. It is advisable for investors to concentrate on securing rates exceeding 4% in bonds or other fixed income assets. Meanwhile, focusing on well-established, large-cap companies, that offer fully franked dividends, is prudent.

Considering our anticipation of increased market volatility in the latter half of the year, potential investment opportunities might emerge to position for a potential economic rebound in 2024. However, these opportunities could come alongside pessimistic headlines projecting unfavorable scenarios.

The combined scenario of sluggish economic expansion and central banks’ continued emphasis on inflation exceeding targets will present ongoing challenges for most high-risk assets. The ongoing economic slowdown across advanced economies could lead to short-term challenges. Riskier assets like equities won’t show clear signs of recovery until the US economic outlook improves, even if safe asset yields decline slightly in the meantime. Given cautious investor sentiment and heightened cash levels, any decline in asset prices is likely to be relatively brief, underscoring the importance of maintaining agility.

We see value / cyclical stocks continuing to outperform, particularly when global economic growth is in question. So, while the outlook is uncertain and as we go into a slower period for earnings, investors should focus on a balance of quality defensives and quality value / cyclical stocks in portfolios.

Investors should focus their attention on ensuring that their overall portfolio is suitable for their risk tolerance, their lifestyle needs and their long-term return requirements. Market performance is difficult to predict, particularly over the short term but putting together an appropriate mix of Australian and international equities, fixed interest, property, cash and alternative investments is more likely to achieve an investor’s long-term goals compared to reacting to market events without the benefit of a plan.

Diversified portfolios with a mix of asset classes have managed to post acceptable returns over longer time frames of 5 or 10 years despite market volatility. This reflects the short-term nature of many of the equity market declines, together with the other asset classes being influenced by different drivers, and therefore providing an offset when equities perform poorly.

Cadre Capital Partners portfolios are typically designed to diversify assets across a range of asset classes to obtain low volatility given a stated return goal. The actual goal, or targeted return, from a portfolio is perhaps the most important influence in a portfolio as once a goal is stated the ability to assign asset allocations becomes a matter of maths. We will always prefer to gain as much return as possible from cash and defensive type assets and then augment this return with the higher risk/higher return possibilities from growth assets.