The concept of short selling is something that is regularly mentioned in financial news, especially during times of crisis. Over the last few years, widely talked-about events, including movies such as The Big Short and also the GameStop phenomenon, have revolved around the practice of short selling assets or seeking to capitalize on it.

For novice investors, grasping the concept of short selling can be particularly challenging. Short selling is a strategy employed to profit from a declining market by essentially “borrowing” shares from a company, selling them at the current market price, and repurchasing them later at a lower price. The profit is derived from the difference between the initial selling price and the subsequent repurchase price.

To comprehend this concept better, it is helpful to compare it with traditional share investment:

Long (Buy)

This is the conventional method of investing, where profit is earned when share prices rise.

- You anticipate a company’s share price will increase.

- You buy shares at $40.

- The share price rises to $54.

- You sell the shares, making a profit of $14 per share.

Short (Sell)

This strategy involves profiting when share prices decline.

- You anticipate a company’s share price will fall.

- You sell 1,000 “borrowed” shares at $58.

- The share price drops to $42.

- You buy back 1,000 shares at $42 to close the trade.

- You make a profit of $16 per share.

But how can you sell shares you don’t own?

The most common method is “Covered Short Selling,” where you borrow shares from someone else through your stockbroker.

It’s important to note that all these transactions are digital, with no physical assets changing hands; it’s about ensuring that the numbers in the regulator’s computer “even out.”

Allowing stock to be short sold can be attractive for lenders, who can charge a borrowing fee passed on to the short seller. However, short sale positions are typically shorter in duration than long trades.

Advantages of Short Selling:

- Profit in a falling market.

- Hedge your portfolio to reduce drawdown in down trending markets.

Disadvantages of Short Selling:

- Difficulty to participate due to obstacles such as additional paperwork, collateral requirements, pre-authorization per trade, higher fees, and a minimum trade size of $50,000.

- Unlimited risk, as the trade is not closed until the original number of shares sold is repurchased.

- The 2008 Volkswagen short-squeeze serves as an example of the unlimited risk in short selling, where panic among short sellers led to a drastic increase in share prices.

Short Selling in Australia

Short selling is allowed in markets to provide liquidity and enhance price efficiency. In 2008, ASIC implemented stricter controls on covered short selling and outright banned naked short selling to address market turmoil. However, this move led to higher volatility and decreased liquidity.

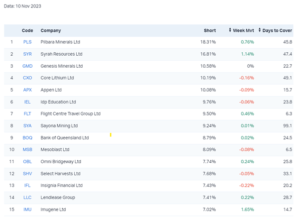

The ASX monitors and publishes short sale transactions, and the Days to Cover metric estimates the number of days it would take for all open short positions in a stock to be covered based on its average trading volume.

Below is a list of the most heavily shorted ASX 200 companies:

Understanding short selling can be challenging, but having a fundamental grasp of the concept is crucial for investors to navigate significant market events. It serves as an additional metric in evaluating individual securities. A security with high short interest may suggest that a considerable number of investors anticipate a decline in its share price. If you have any questions about the content provided, please don’t hesitate to reach out, and we are here to assist you in gaining a deeper understanding.